Private Funds

Selective strategies. Exceptional managers Backed by themes. Built for wealth.

REGULATED BY SEBI

Structured private market funds that give you access to India's most promising opportunities.

Expert-curated • Actively Managed • Starting at ₹25L

High-Caliber Funds, Selectively Curated

Opportunities chosen with conviction, backed by thesis, track record and rigor.

High-Caliber Funds, Selectively Curated

Opportunities chosen with conviction, backed by thesis, track record and rigor.

Why Most Funds Don't Make the Cut

We pick funds that consistently outperform through structural advantages in deal access, due diligence, and portfolio management.

Fewer Bets, Higher Stakes

We select funds that concentrate on their investments without over-diversifying with 20+ allocations.

Beyond the Hype Cycle

We avoid funds chasing last year's winners and focus on those building tomorrow's market leaders.

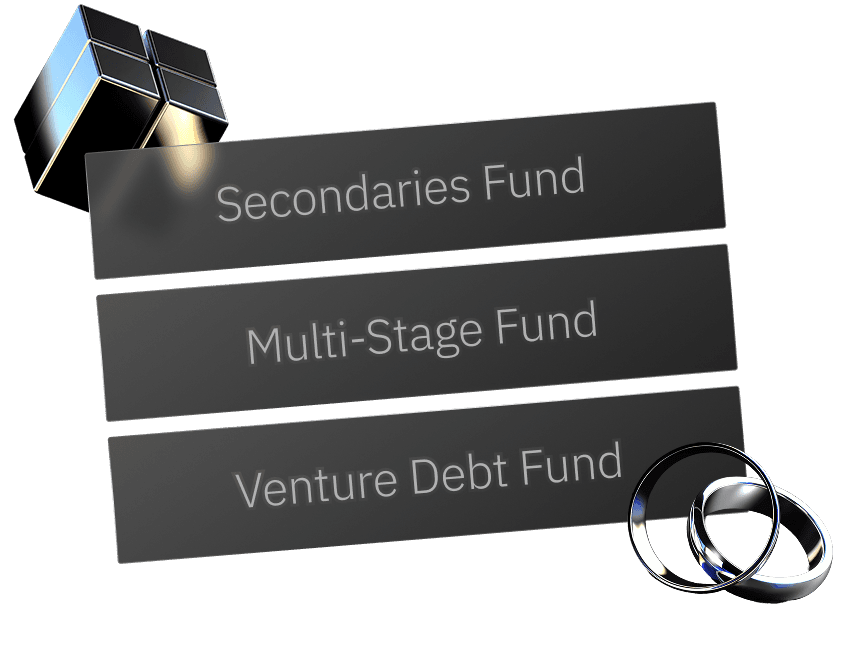

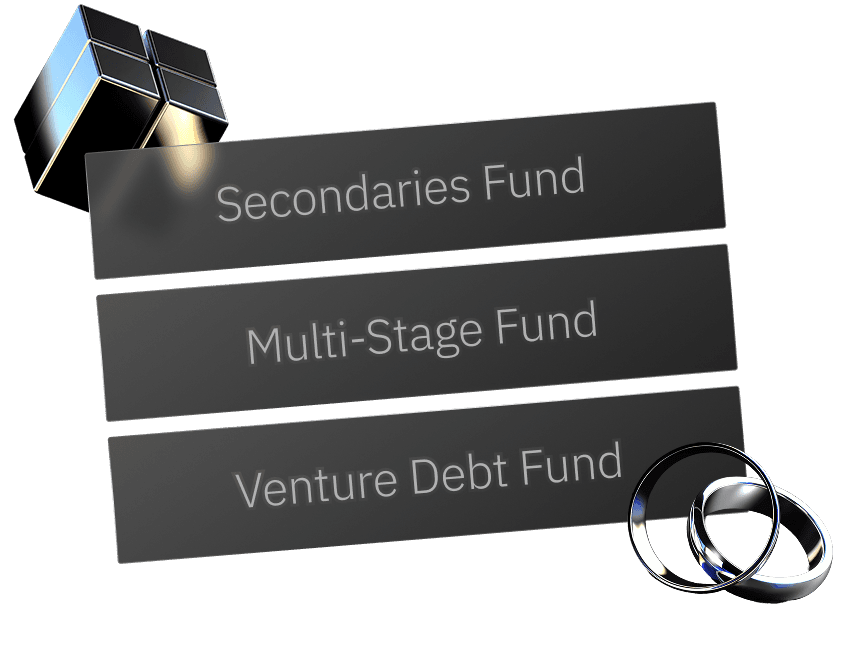

Fund Offerings

Fund Offerings

TARGETING 26-30% IRR

TARGETING 26-30% IRR

Access to market-leading companies through secondary opportunities

Invest in companies typically reserved for institutional investors

IPO/exit potential within ~36 months

Secondaries Fund

Buy Tomorrow's Winners at Yesterday's Prices

Select Fund

TARGETING 18-20% IRR

TARGETING 18-20% IRR

Venture Debt Fund

Strategic Debt Financing

Revenue-backed growth companies

Sector-agnostic, cash-generative focus

Warrants for 5–15% equity upside

Fully Subscribed

TARGETING 30-33% IRR

TARGETING 30-33% IRR

Multi-Stage Fund

Capital for Every Chapter of Growth

EARLY (≤30%)

Seed-Series A (market validation)

GROWTH (≤50%)

Series B-C (scaling)

LATE/PRIVATE EQUITY (≤30%)

Pre-IPO and exit-ready

Fully Subscribed

Frequently Asked Questions

Frequently Asked Questions

What is the minimum investment amount for funds?

What is the minimum investment amount for funds?

How can I see my fund holdings and track performance?

How can I see my fund holdings and track performance?

What kind of fees should I expect?

What kind of fees should I expect?

How does a Category II AIF differ from a Category I Angel Fund?

How does a Category II AIF differ from a Category I Angel Fund?

How do I sign up for fund investments?

How do I sign up for fund investments?

View all FAQs

DISCLAIMER: (i) Investments in Fund units and securities are subject to market risks, and the NAV may fluctuate based on market conditions. (ii) Infinyte and its affiliates do not provide investment advice. Investors should review all scheme documents carefully and consult their legal, tax, and financial advisors before making any investment decisions. (iii) Investments in Fund units are subject to terms and conditions of the Fund Scheme.

Reach out to us